Binance | The World's Largest Cryptocurrency Exchange by Trading Volume, Lifetime 10% Discount on Fees!

Binance

A Beacon for the Chinese, the First Choice for Buying and Selling Cryptocurrency, Reliable and Secure

Main Text

Binance, known as 币安 in Chinese, is an exchange founded by former OKCoin CTO Zhao Changpeng. It is currently the largest cryptocurrency exchange in the world by trading volume. Initially, they only had one website, binance.com, but later, due to regulatory pressure in the U.S., they created a separate site to serve U.S. users, binance.us. Binance's initial trading fee is up to 0.1%, and the larger your trading volume, the lower the fee. If you hold Binance's platform token BNB, you can get an additional 25% discount on fees, making it as low as 0.075%, which is much lower than Coinbase's 2% trading fee. Moreover, their speed of listing new coins is much faster than Coinbase, Gemini, and Robinhood. If readers want to invest in new coins, they can try Binance.

If you are a U.S. user, Binance US does not currently support all U.S. states. Users in Connecticut, Hawaii, Louisiana, New York, North Carolina, Texas, Vermont, and Washington cannot use it yet. If you are in these states, you can only use the other exchanges mentioned above or use a VPN to access binance.com.

Besides cryptocurrency trading, Binance offers several features that I really like and have been using:

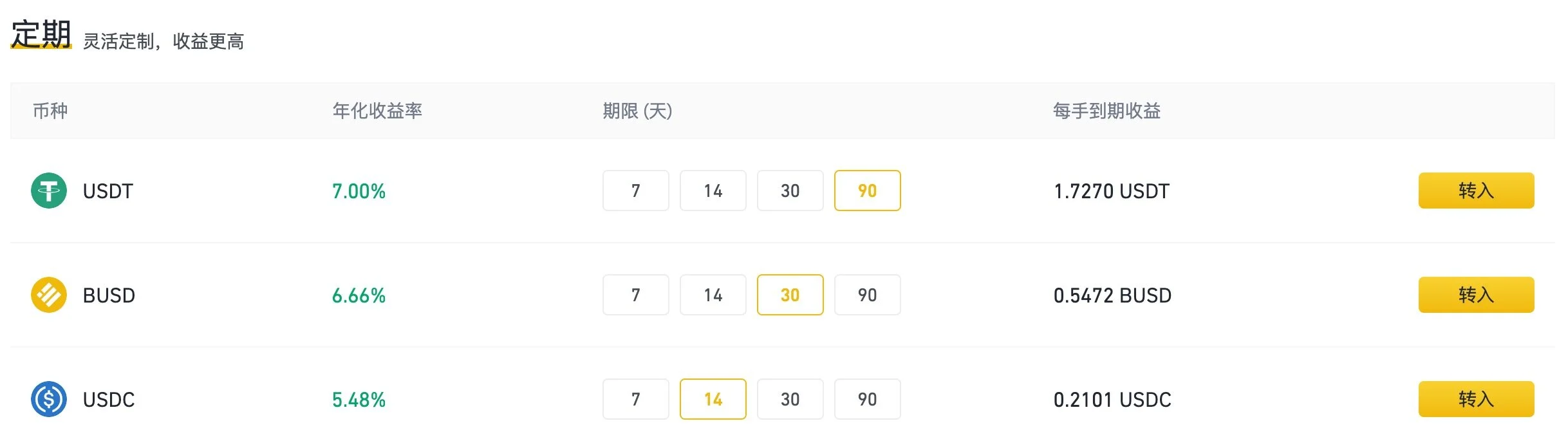

Binance Savings

Binance offers flexible savings for 58 types of cryptocurrencies, with annualized interest rates ranging from 1% to 10%. For example, BTC is currently at 1.2%, USDT at 6%, ETH at 0.87%, and FIL at 4.23%. Binance also offers fixed savings for BUSD, USDT, and USDC, supporting 7, 14, 30, and 90-day terms, with annualized returns ranging from 6.31% to 8%. With U.S. domestic bank savings rates being negative when accounting for inflation, keeping money in the bank is a loss. 😭 Investing in fixed savings with stable U.S. currencies on Binance offers low risk, high, and stable returns, making it a good investment channel!

View fullsize

Curious readers might wonder: there's no free lunch, is there a catch with such good returns? My understanding is that Binance's savings product aims to encourage people to transfer various coins to their platform. Once your coins are there, you're likely to trade, and Binance can earn fees from your trades. Additionally, transferring coins to Binance is like lending them interest-free, and like stock brokers, they can lend these zero-cost coins to futures traders to earn interest. Binance savings simply shares a portion of the futures trading interest with end-users, making it a win-win situation.

Liquidity Mining

If you know about Uniswap, you should understand its underlying principle, AMM (Automated Market Maker), where anyone can become a liquidity provider to earn trading fees. Binance, as a centralized exchange, faces challenges from decentralized exchanges like Uniswap, risking a decline in trading volume. Therefore, they ingeniously created a centralized version of Uniswap.

View fullsize

Binance Liquidity Mining Pool Yield

Binance's liquidity mining pools are divided into two categories: Stable and Innovative. Stable pools mainly consist of stablecoin pairs and BTC/wBTC pairs, where returns do not experience unilateral effects, and earnings grow steadily. Innovative pools may experience unilateral effects, such as if ETH suddenly surges, causing changes in the ETH/DAI trading pair's yield curve. I am risk-averse and generally only buy stable pools, like BTC/wBTC, so my idle Bitcoin can earn an annualized return of 6%, which is quite delightful!

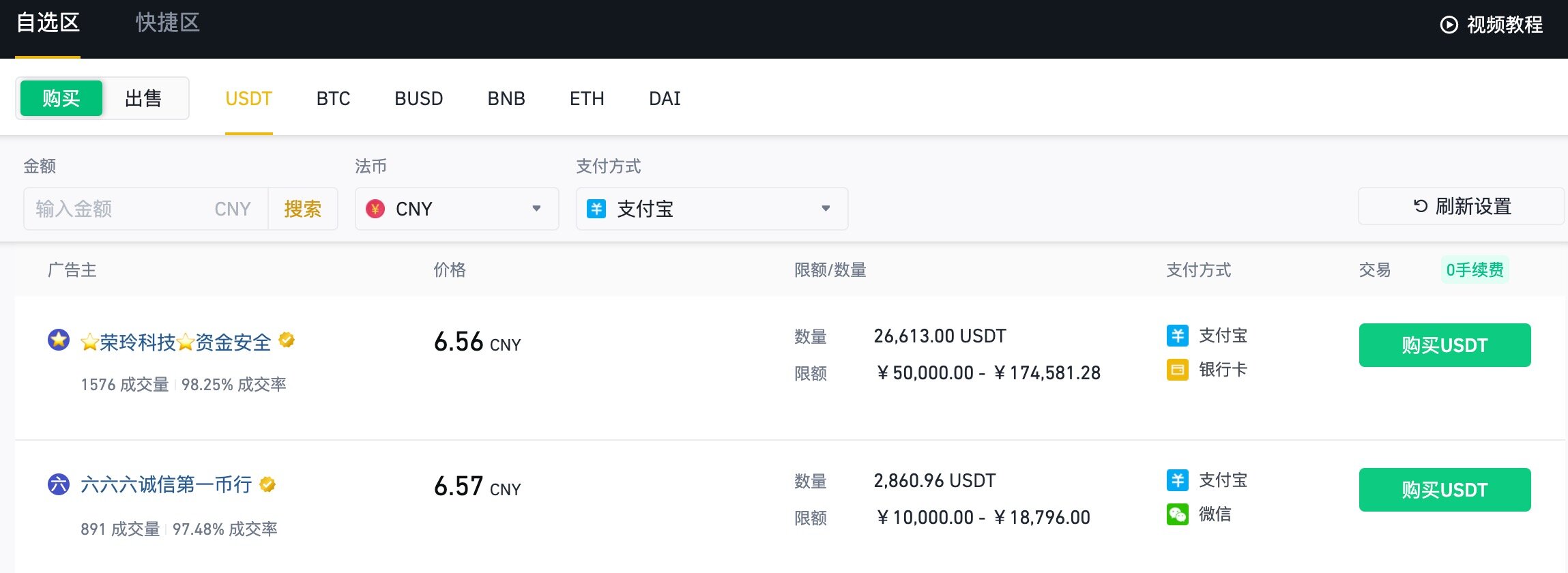

P2P RMB Buying and Selling Cryptocurrency (Binance generally refers to it as C2C)

Due to Chinese policy restrictions, exchanges cannot directly facilitate RMB buying and selling of cryptocurrencies. Many Chinese exchanges have found alternative ways to allow users to indirectly buy and sell with RMB. P2P is a typical method because the transaction is between two users, not between the platform and the user, allowing the exchange platform to circumvent policy restrictions. RMB can currently be used to buy and sell USDT, BTC, BUSD, BNB, ETH, and DAI, supporting Alipay, WeChat, and bank transfers.

View fullsize

Binance P2P RMB Buying and Selling Cryptocurrency

P2P carries certain risks, as the other party is not the platform and may not send you money or coins. Binance's solution is to escrow the seller's coins. If the buyer has successfully transferred RMB but the seller is reluctant to release the funds, since the seller's coins are still on the Binance platform, Binance will forcibly transfer from the seller's account to the buyer's account, effectively solving this trust issue. I have traded over 20 times in the OTC self-selection area, and each time the transaction is completed within five minutes.

Click to Register on BINANCE.COM for a 10% Cashback on Trading Fees

If you have a better offer, feel free to share your link or referral code in the comments section!_